- 20Feb2023

-

Home prices holding up relatively well in Alberta

Home prices holding up relatively well in Alberta

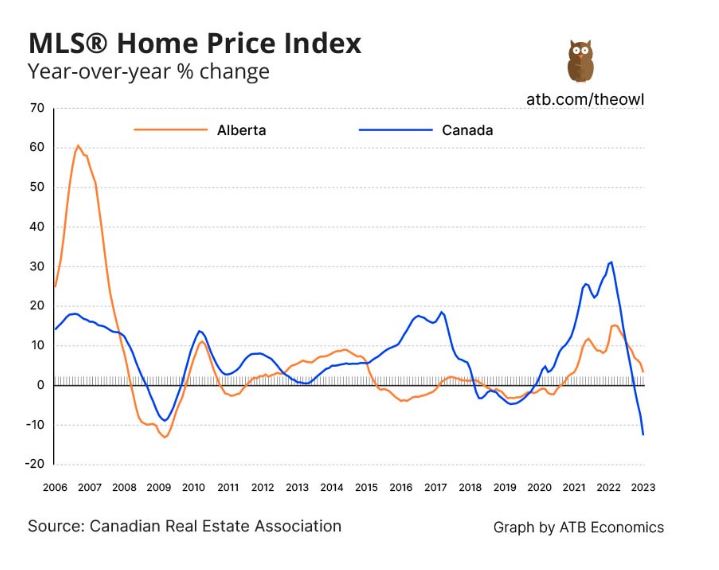

Benchmark* home prices have been falling on a monthly basis in both Canada and Alberta for almost a year now, but the drop has not been as steep in Alberta.

As of January 2023, the composite benchmark price in Alberta was 6.5% lower than the peak reached eight months earlier, but was still 3.3% above where things stood in January 2022.

Nationally, the benchmark in January 2023 was 17.8% lower than the peak reached the previous March and 12.4% lower than in January 2022.

In Calgary, the January 2023 benchmark was only 4.2% below the high-water mark reached in May 2022 and was 6.1% higher than 12 months earlier.

It was a different story in Edmonton, where the benchmark was 11.6% below the peak set in 2022 and 3.6% lower than 12 months earlier.

The composite benchmark price in January 2023 was $713,700 in Canada, $451,600 in Alberta, $509,900 in Calgary, and $362,200 in Edmonton.

Higher borrowing costs are likely to continue to weigh on home prices as we get deeper into 2023, but the Alberta market has held up—and is expected to continue to hold up— better than the country as a whole.

(HPI) model is used to calculate benchmark prices in key Canadian markets. A “benchmark home” is one whose attributes are typical of homes traded in the area where it is located and includes single family homes, townhouse/row units and apartment units.

Answer to the previous trivia question: It takes approximately six million parts to build a Boeing 747.

Today’s trivia question: How many rooms are there in Buckingham Palace?

Higher borrowing costs have weighed on home prices

- 20 Feb, 2023

- admin

- 0 Comments

Comments